Business Insurance in and around Auburn

One of the top small business insurance companies in Auburn, and beyond.

Helping insure small businesses since 1935

- Upstate NY

- Metro NY

Your Search For Outstanding Small Business Insurance Ends Now.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes problems like a staff member getting hurt can happen on your business's property.

One of the top small business insurance companies in Auburn, and beyond.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

With options like business continuity plans, worker's compensation for your employees, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Carmine Costantino is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Take the next step of preparation and visit State Farm agent Carmine Costantino's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

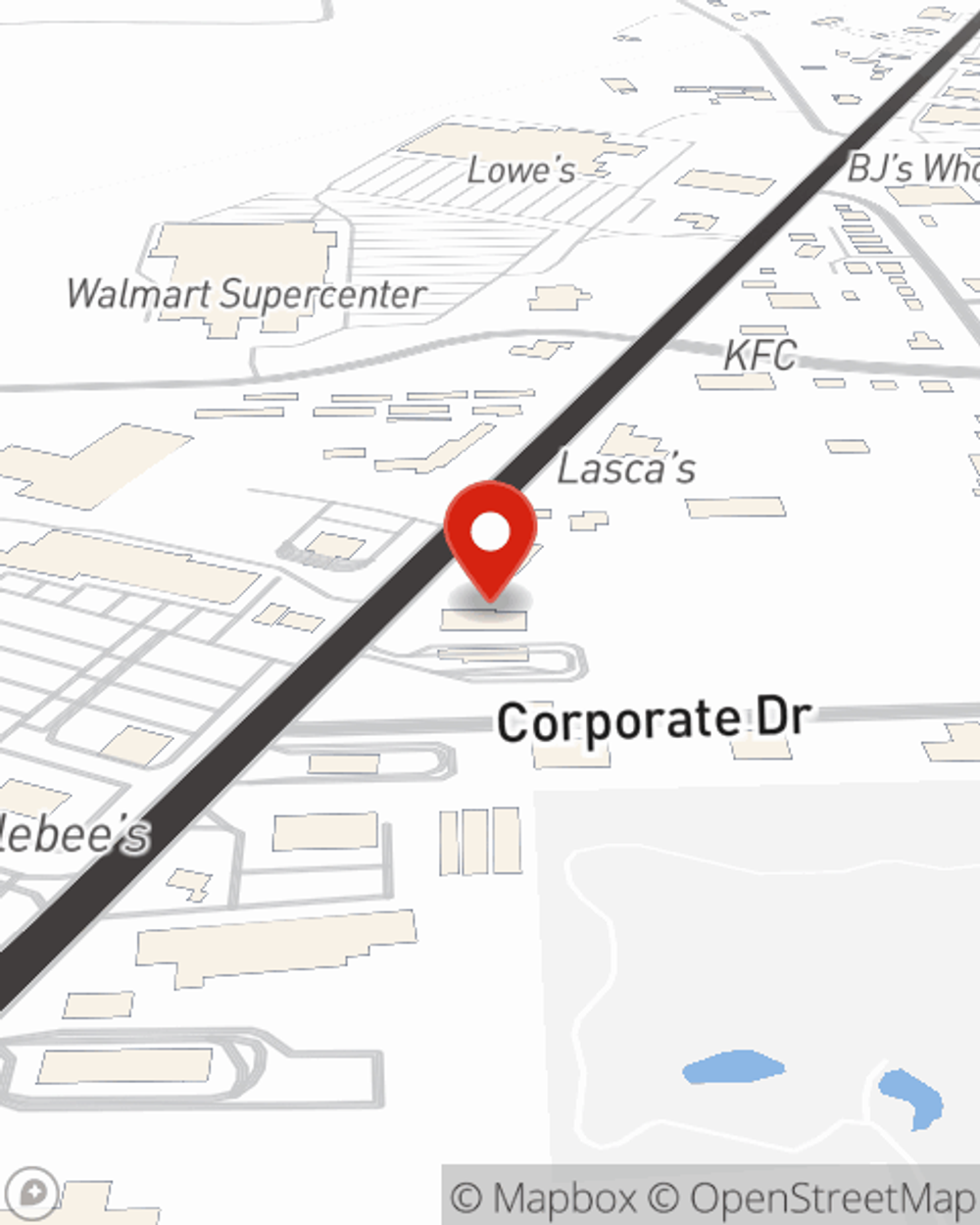

Carmine Costantino

State Farm® Insurance AgentSimple Insights®

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.